Understanding Financial Metrics That Matter

Discover which financial metrics are most important for your business growth and how to use them effectively.

Michael Chen

Understanding Financial Metrics That Matter

Financial metrics provide valuable insights into your business's performance. However, not all metrics are created equal. In this article, we'll explore the financial metrics that truly matter for business growth and how to use them to drive better decision-making.

Why Financial Metrics Matter

Before diving into specific metrics, it's important to understand why tracking financial metrics is crucial:

- They provide objective measures of business performance

- They help identify trends and patterns over time

- They enable data-driven decision making

- They highlight areas needing improvement

- They facilitate communication with stakeholders

Without proper metrics, you're essentially flying blind, making decisions based on gut feeling rather than concrete data.

Key Financial Metrics to Track

Here are the most important financial metrics that every business should monitor:

1. Gross Profit Margin

What it is: The percentage of revenue that exceeds the cost of goods sold (COGS).

Formula: (Revenue - COGS) / Revenue × 100

Why it matters: Gross profit margin indicates how efficiently you're producing and delivering your products or services. A declining gross margin may signal rising costs or pricing pressure.

2. Net Profit Margin

What it is: The percentage of revenue that remains as profit after all expenses.

Formula: Net Profit / Revenue × 100

Why it matters: Net profit margin shows how much of each dollar of revenue translates to actual profit. It's the ultimate measure of your business's profitability.

3. Cash Flow from Operations

What it is: The amount of cash generated from your core business operations.

Formula: Net Income + Non-Cash Expenses - Increases in Working Capital

Why it matters: Even profitable businesses can fail if they run out of cash. This metric shows whether your core business is generating or consuming cash.

4. Working Capital Ratio

What it is: The ratio of current assets to current liabilities.

Formula: Current Assets / Current Liabilities

Why it matters: This ratio indicates your business's short-term financial health and ability to meet immediate obligations. A ratio below 1.0 suggests potential liquidity problems.

5. Accounts Receivable Turnover

What it is: How quickly you collect payment from customers.

Formula: Net Credit Sales / Average Accounts Receivable

Why it matters: A higher turnover rate indicates efficient collection practices, which improves cash flow.

6. Inventory Turnover

What it is: How quickly you sell through your inventory.

Formula: Cost of Goods Sold / Average Inventory

Why it matters: Higher turnover rates indicate efficient inventory management, reducing storage costs and the risk of obsolescence.

Industry-Specific Metrics

While the metrics above apply to most businesses, certain industries have specific KPIs that are particularly relevant:

Retail

- Sales per square foot

- Same-store sales growth

- Inventory shrinkage

SaaS

- Monthly recurring revenue (MRR)

- Customer acquisition cost (CAC)

- Customer lifetime value (CLV)

- Churn rate

Manufacturing

- Overall equipment effectiveness (OEE)

- Production yield rate

- Capacity utilization

Using Metrics to Drive Growth

Once you're tracking these metrics, you can use them to make informed decisions about your business. For example:

- If your gross profit margin is declining, you may need to adjust your pricing or reduce costs

- If your accounts receivable turnover is low, you may need to improve your collections process

- If your inventory turnover is low, you may be tying up too much cash in inventory

The key is to:

- Establish baselines for each metric

- Set targets for improvement

- Monitor regularly (daily, weekly, or monthly depending on the metric)

- Take action when metrics deviate from targets

- Adjust strategies based on the results

Common Pitfalls to Avoid

When working with financial metrics, be careful to avoid these common mistakes:

- Focusing on too many metrics: Choose a handful of key metrics rather than tracking everything possible

- Looking at metrics in isolation: Consider how metrics relate to each other for a complete picture

- Ignoring industry benchmarks: Compare your performance to industry standards

- Failing to act on insights: Metrics are only valuable if they drive action

- Not adjusting for seasonality: Many businesses experience natural fluctuations throughout the year

Conclusion

By focusing on these key financial metrics, you can identify areas for improvement and drive sustainable growth for your business. Remember that metrics should serve as tools for better decision-making, not just numbers to report.

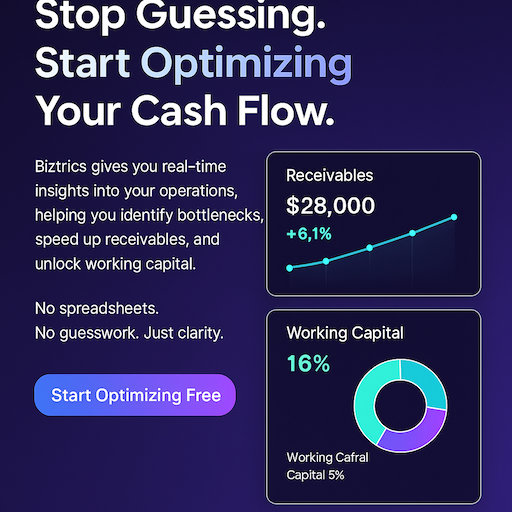

With Biztrics' financial analytics platform, you can easily track all these metrics in real-time, with customizable dashboards that provide instant insights into your business performance. Our automated reporting and analysis tools help you move beyond data collection to actionable business intelligence.